There's quite a few things you need to know before beginning your journey down the financial independence retire early path

Don't get discouraged though

Because the more you learn about the different

Components to the fire movement the more you'll realize that these are all things. You should know whether you want to retire early or

retire on time in this video

I'm going to go through a few of the main components that will determine how quickly you can declare financial independence or early retirement

If you're clueless about what the fire movement is all about

then I suggest watching a video I made that will break it all down for you link is in the description or somewhere around my

Head as I mentioned in that video most people will naturally gravitate towards financial independence

Since it doesn't appeal to most to just retire early and not do anything with the rest of their lives

Hey

I'm Jared from debt-free blueprint where I show intelligent people like you how to get out of debt and create

Freedom through your finances using the debt free blueprint smash that thumbs up button

leave a comment down below

Asking me any additional questions you have surrounding this topic and I'll get them answered for you

If you want more personal finance videos just like this one then hit that subscribe button and a notification bell. So you too YouTube YouTube

Knows to deliver them to you. Let's get into it, right? Yeah

First up is your age just like anything the earlier you get started the better

Unfortunately for most of us we weren't made aware of this movement until a time when it would seem like it was way too late

Now this isn't to say that someone who's in their late 30s or 40s

Can't pursue fire. You definitely can but the advantage younger people have is time

More time to actually focus on pursuing financial independence and more time invested in the markets one advantage people in their 30s and 40s

Could have is that they've already been investing up until this point

If that's the case then changing your current path to a more financial independence

retire early path is going to be a lot smoother on the other hand if you are in your 30s and 40s with next to

Nothing invested then you still have time but you are essentially going to need a bigger shovel

You're going to have to really maximize some of the other areas. We're going to talk about later in this video

Keep in mind that financial independence is basically having enough in investments that are generating you money to pay for your expenses

Forever most people who are considered financially independent are still doing some sort of work for money

But they don't rely on that money to cover their normal expenses technically

This means that someone starting this process a little later can save up enough to withdraw thirty thousand dollars per year to cover their basic

Needs and work a job that they really enjoy that only pays twenty thousand dollars per year because it hits them right in the fields

And if I know you you love those fields and I think we all like to get hit in the fields

Sometimes next up is your income the more you make the easier it will be for you to max out all of your retirement

accounts and invest in other areas to hit your fire numbers sooner now just because you make

$200,000 per year doesn't mean you can automatically save and invest

More than a person making half that we'll talk about that later in the video if you want to retire in 15 years

Then you need to focus on squeezing everything out of your earning potential for those 15 years

Think of those 15 years as life or death and take advantage of all of them go

really really hard that way you can feel comfortable letting up on the gas when you do finally decide to retire or

Declare financial independence you're sacrificing today so that you can live a more enjoyable life tomorrow delayed pleasure is the key

I made a video about increasing our income and making money online to help you out with this

I'll throw links in the description for you to check out after this video

There's a lot of debate surrounding the income topic when it comes to financial independence retire early

Some people will trash on the higher earners like individuals in the IT industry or engineers because on average they have higher

Incomes and naysayers might say something. Like of course they can do it. It's so much easier for them because they make more money

Okay, and those individuals are making sacrifices to achieve fire just like everyone else

I honestly think that having that view is extremely

Closed-minded, of course, it helps they make more money

But what does that have to do with you and your situation?

If you don't make as much money as them and you want to be able to so that you can start

Investing more then what is stopping you from doing that?

The sky is the limit when it comes to how much each of us can earn

We need to remove those limiting beliefs we have about why we can't do this why we can't do that and why they have it

So much easier than the rest of us. Sure

They might be able to declare financial wind penance or early retirement sooner than you but who cares this buyer journey is about you

How you're going to do it and most importantly why you're trying to achieve this

It's not about them another extremely

Important factor when it comes to financial independence and early retirement is your savings rate

You could be 21 years old making a hundred and fifty thousand dollars per year

But if your savings rate is trash then this whole thing will never work

Your savings rate is how much you're saving in regards to how much you were earning if your take-home pay is a hundred thousand dollars

per year

but your

Expenses total 93 thousand dollars per year and you're actually saving and investing the difference

then your savings rate is seven thousand dollars or

Seven percent if you are working towards financial independence and only saving seven percent then you need to get that number up

It's just not going to be enough

Let's look at three scenarios and break down the math if you wanted to leave your job and live off of your investments in

15 years in scenario 1 if you invest

583 dollars per month or

7000 dollars per year. We'll just assume a 7 percent return on your money. Then your investments have the potential to be worth

$175,000. Yes

that sounds like a lot of money because it is but it's not enough to declare financial independence in scenario 2

Let's assume you decide to make it a point optimize your spending and you've got your savings rate up to

21 percent that would mean you would be investing twenty-one thousand dollars per year for 15 years or

1750 per month your investments could potentially be worth over five hundred and twenty seven thousand dollars in

fifteen years once again

Yes, that is a lot of money and some people may be able to survive living off that amount

But I would personally want more than that if I was declaring financial independence today in

scenario 3 if you decided that declaring financial independence or early retirement was

Extremely important to you and you nearly double that 21 percent savings rate to a 40 percent savings rate

Then your money has the potential to be worth over

$1,000,000. I can't stress enough how powerful your savings rate can be if you make it a point to focus on that in your life

You decided that you wanted to add another

five years to that so that you would retire in 20 years and you invested at the same rate of

1750 per month then your investments have the potential to be worth over eight hundred and sixty

thousand dollars

Just by adding an additional five years to that timeline

optimizing your

Spending in the biggest areas of your life will help you achieve a higher savings rate

The three biggest expense areas for most people are housing transportation and food

Those are the main three that you should focus on

reducing to find some extra money to put towards your retirement if you truly want to be working towards fire if you do want to

eventually reach financial independence retire early

then I would go as far as saying that it is a requirement to reduce your spending in all three of those areas the thought

of actually making this happen might sound outrageous to you and I get it but

Pursuing fire is not something that is only for the privileged

It's for the average person like you and me being able to pursue financial independence retire early is sort of a luxury

but it's only luxury because if you are focused on pursuing Phi then you've already made smart money decisions leading up to this point or

You chose to correct your past money mistakes to get on the right track with your money

kind of like my past huge mistake of racking up eighty-two thousand dollars in debt and

Eventually getting it all paid off your financial independence early retirement journey is waiting for you

But the first step is to focus on getting rid of your bad debt as soon as possible

leave a comment down below

Asking me any additional questions that you have about the fire movement and I'll make sure to get them answered for you as I make

more videos on this topic

I'll create a playlist and put the link in the description of this video so you can find them a whole heck of a lot

Easier sign up to get on the money management course waiting list. The link is in the description

make sure to smash that thumbs up button and pick up your free copy of the debt free prep workbook hit that subscribe button and

The notification bell to get more personal finance videos just like this so we can start getting you to a point where you are financially

Free I'll see you in the next one friends. Adios

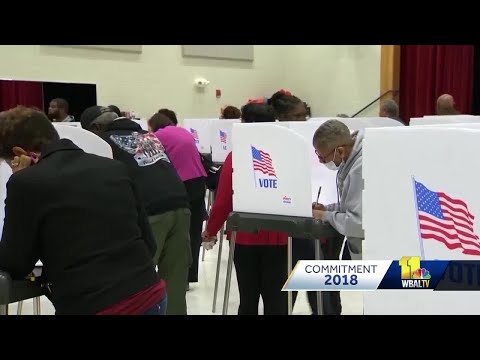

For more infomation >> You won't find a polling site at HEB stores in Travis County - Duration: 3:00.

For more infomation >> You won't find a polling site at HEB stores in Travis County - Duration: 3:00.  For more infomation >> Election Day: Everything you need to know about voting - Duration: 1:53.

For more infomation >> Election Day: Everything you need to know about voting - Duration: 1:53.  For more infomation >> What you need to know for Election Day 2018 - Duration: 3:01.

For more infomation >> What you need to know for Election Day 2018 - Duration: 3:01.  For more infomation >> 強盜邏輯:美海軍高官又在賊喊捉賊,對中國軍隊指手畫腳 - Duration: 7:48.

For more infomation >> 強盜邏輯:美海軍高官又在賊喊捉賊,對中國軍隊指手畫腳 - Duration: 7:48.

For more infomation >> CRAZY RICH ASIANS FILMING LOCATIONS - 7 PLACES YOU HAVE TO VISIT IN SINGAPORE - Duration: 7:58.

For more infomation >> CRAZY RICH ASIANS FILMING LOCATIONS - 7 PLACES YOU HAVE TO VISIT IN SINGAPORE - Duration: 7:58.

For more infomation >> The animation genius you've probably never heard of | BBC Ideas - Duration: 2:52.

For more infomation >> The animation genius you've probably never heard of | BBC Ideas - Duration: 2:52.

For more infomation >> So, what are you voting on today? See what's on the ballot - Duration: 4:11.

For more infomation >> So, what are you voting on today? See what's on the ballot - Duration: 4:11.  For more infomation >> What you need to know before heading to the polls - Duration: 5:01.

For more infomation >> What you need to know before heading to the polls - Duration: 5:01.

For more infomation >> Election Day: Everything you need to know - Duration: 2:26.

For more infomation >> Election Day: Everything you need to know - Duration: 2:26.

For more infomation >> Why you may receive unwanted political robocalls - Duration: 1:23.

For more infomation >> Why you may receive unwanted political robocalls - Duration: 1:23.

Không có nhận xét nào:

Đăng nhận xét